In 2025, homeowners insurance is more confusing than ever, leaving many at a loss about what it truly covers. Amidst the chaos, one hidden truth remains: most homeowners are unknowingly underinsured, risking significant financial loss.

With climate change intensifying natural disasters, understanding homeowners insurance is critical. New laws and market shifts make it urgent for everyone to reassess their coverage immediately. Get ready to uncover the surprising world of insurance.

Did you know that 30% of homes are covered under outdated policies that drastically undervalue the cost of damages? Even more astonishing is the revelation that many insurers quietly exclude certain extreme weather events. But that’s not even the wildest part…

An overlooked fact is that certain thefts and household accidents often aren’t covered. Policies vary greatly, yet a staggering number of agents don't disclose key exclusions unless asked. But that’s not the full story...

What happens next shocked even the experts: you’re about to discover the unexpected ways to maximize your coverage and minimize costs, something even seasoned homeowners often miss. Let's dive deeper into the tangled web of homeowners insurance.

Most homeowners believe their insurance covers all forms of damage or loss, but hidden gaps leave many unprotected. Common misconceptions include full coverage for flooding, mold, or sewer backup, risks often ignored until disaster strikes. But here's an insider tip: scrutinizing policy fine print could save thousands. Consumer Reports advocates for double-checking disaster-specific clauses, ensuring they're expressly included. Otherwise, you might face unexpected out-of-pocket expenses.

Sewer backup claims, for example, are a frequently denied issue. Many homeowners are unaware they need additional coverage for this relatively common occurrence. Investing in a water backup endorsement, typically at a nominal cost increase, can prevent financial headaches down the line. Moreover, investigating what constitutes “Acts of God” in your policy is prudent, as this is often misunderstood or poorly defined.

Given the rise in severe weather events, flood insurance is increasingly crucial, yet it's not generally included. FEMA notes a sharp rise in unpaid claims due to this oversight. This oversight must be addressed early to avoid devastation costs that could lead to financial ruin. Planning ahead, by adding necessary flood coverage, safeguards your home against unforeseen natural disasters.

Unbeknownst to many, insuring treasured valuables like jewelry, art, or electronics typically requires additional riders. These specialty policies offer tailored coverage that regular homeowner plans overlook. Before renewing your policy, catalog your valuables and inquire about rider options. You’ll find there’s much more learn, as the intricate details of these policies often harbor the greatest surprises.

The underlying causes of insurance premium increases can be elusive, but understanding them is key to controlling costs. Many are unaware that their home's age and location, along with crime rates in their area, significantly impact their insurance rates. Data shows a direct correlation between neighborhood security features and premium reductions. Enhancing your home’s safety, perhaps with smart systems or regular maintenance, might save you handsomely in the long run.

Insurers also factor in your credit score when calculating premium costs, a practice unbeknownst to many homeowners. A strong credit score often yields a discount, countering increases tied to claims history or overdue bills. Improving your credit can be a strategic move in curbing rising insurance costs, potentially cutting more than just your premium rates.

But did you realize renovations might actually spike your premiums? Upgrades that increase home value, like expanded square footage or high-end installations, attract higher premiums. Informing your insurance provider about changes and negotiating your coverage can prevent unexpected expense hikes. Exploring different providers can uncover tailored options suited to your newly renovated space, often at competitive rates.

An often-overlooked factor is that insurance deductibles directly affect premium amounts. Choosing a higher deductible decreases monthly costs but could risk significant upfront payments during a claim. Balancing deductible choices with monthly expenses is crucial, minimizing financial stress if damages occur. The choice is yours, but diving deeper into these options reveals astonishing potential cost savings.

Amidst the flood of insurers promising peace of mind, selecting the right one can be overwhelming. With competitive pricing, it often comes down to service quality and reliability in crisis. Research has shown that companies like State Farm and Allstate consistently rank high for customer satisfaction and claim handling. But beyond ratings, it's crucial to personalize your choice based on coverage needs and financial considerations.

Understanding company-specific discounts can provide lucrative benefits. Bundling insurance policies, for example, could unlock substantial savings not immediately obvious. Insurers frequently pass overlooked loyalty discounts to long-term customers, offering both affordability and stability. Thoroughly examining such perks often reveals financial benefits worth noticing.

Yet not all providers handle claims with equal efficiency. Review scrutiny unearths shocking disparities in payout timeliness across the industry. Prioritize companies with proven track records for fast and fair claims processing and consider their customer support reputation. Satisfaction ratings and persistence through unforeseen events play vital roles in choosing the ideal insurer.

Additionally, emerging market disruptors like Hippo Insurance introduce new standards through technological innovation, offering streamlined digital solutions that are reshaping the landscape. Their aggressive use of technology could become pivotal in transforming homeowners insurance. This technological wave is just the beginning, as traditional players rush to adapt or risk falling behind.

The insurance landscape is shifting dramatically, thanks to burgeoning technological advancements. Companies now deploy AI-driven analytics to assess risks accurately, offering unprecedented customization of premiums and coverage. Tools like Lemonade’s AI Jim engage policyholders in real-time, streamlining claims into mere minutes. The shift promises efficiency but also presents concerns about privacy and data security.

Smart home technology isn’t just convenient — it’s enticing insurance companies to offer otherworldly premium discounts. Integrating smart security systems or water leak detectors might cut premiums by up to 20%, according to some reports. The flip side of this technological marvel is ensuring interconnected devices do not inadvertently expose vulnerabilities within your home's cyber networks.

Another game-changer is blockchain technology, promising tamper-proof documentation that could speed up claims processing and reduce fraud. It’s gaining traction among innovative insurers championing transparency and efficiency. But questions remain about the implementation costs versus benefits, as deploying blockchain across the industry may require significant investment or collaborative development.

Tech innovations are revolutionizing traditional insurance roles too, with virtual assistants now handling everything from policy questions to quotes. With eyes set on further automation, the human touch might diminish, raising concerns about the loss of personalized customer service. This impending sea change harbors most unexpected influences yet to unfold in the coming years.

The debate intensifies over how a home’s location dictates insurance decisions. Beyond the obvious factors like neighborhood safety, proximity to emergency services can heavily influence rates. Homes nearby fire departments, hydrants, or hospitals enjoy lower premiums, signaling the importance of geography in financial planning for potential costs imagined only during crises.

A frequently underestimated factor is local climate, which fundamentally alters coverage requirements. Areas prone to hurricanes or wildfires are experiencing skyrocketing rates and often require additional specialized policies. Conversely, temperate zones benefit from modest pricing, reflecting reduced risk. This divide underscores the intricate balance insurers maintain between environmental threats and preparedness.

Recently, urban flight trends have raised new concerns for insurance firms. As more people relocate to rural areas, previously unimaginable risks like wildlife-related damages come into focus. This migration evolution demands revised assessments for rural living, inviting homeowners to rethink their coverage under these new parameters. Surveys suggest insurers are adapting to this shift, albeit at varied paces.

Infrastructure improvements, like reinforced roads and reliable power grids, further impact insurance rates by reducing living disruptions and risk exposure. Communities prioritizing infrastructure investments may leverage favorable insurance conditions, delivering peace of mind alongside utility reliability. It's these nuanced insights that, while initially hidden, emerge as deciding factors in fostering better, location-specific coverage.

In every policy lies a maze of exclusions that could redefine your understanding of what’s truly covered. One sneaky exclusion is pests; damage from termites or rodents is generally not covered, despite their common occurrence. Homeowners learning this the hard way suffer costly repairs unaided by insurance.

Exclusions often encompass maintenance-related damages as well. Insurers see neglect as preventable, urging homeowners to regularly inspect and maintain crucial systems. Whether it’s plumbing, electrical, or roofing, proactive care saves future headaches — and wallet aches — from denied claims. Adopting routine maintenance tasks prevents unfortunate surprises.

Also lurking in policies are limitations on mold, fungus, and remediation expenses. These are deemed preventable with proper upkeep, which means exclusion from standard coverage. The cost to mitigate such issues without insurance can be overwhelming. Understanding this aspect ensures preparedness to financially tackle potential household hazards.

Newer policies incorporate cyber threats due to increased reliance on smart-home tech. Yet older policies may lack this consideration, leaving homeowners vulnerable to modern sabotage forms — unauthorized access to smart devices, for example. Updating policies to include cyber protection is now essential, as technology's integration into home environments isn't slowing down.

The DIY approach to home security systems can be appealing but be warned — incomplete installations might not guarantee insurance discounts. Some insurers demand approved professional installations as a prerequisite to qualifying for reduced rates. Industry standards underscore the importance of meeting insurance criteria to benefit from security upgrades.

Improper DIY setup risks creating blind spots, leaving homes inadequately secured. For example, coverage lag in outdoor areas is a notorious deficiency in amateur setups. Seeking guidance helps identify vulnerable spots that technology alone can't address, ensuring comprehensive protection that insurers trust.

On the flip side, excessive confidence in manufacturers’ reliability might lead to missteps. Services like monitoring subscriptions are vital, as unattended systems could miss urgent alarms. Incorporating professional monitoring ensures incidents are swiftly addressed, reassuring insurers of your home’s prepared stance against threats.

DIY systems do promise value but without comprehension of operational complexities, it could lead to unexpected costs down the line. Affordable smart technology needs to be balanced with professional oversight for optimal insurance benefits. Navigating this labyrinth requires a blend of innovation and caution to maximize protection and potential savings.

Insurance agents can greatly influence policy decisions, acting as guides through policy complexities. Yet, motivation often drives an agent's advice, potentially skewing the coverage you receive. Understanding their commission-based reality is essential, as it may contrast with your personal best interests.

Beware of agents pushing overly conservative coverage aimed at maximizing sales targets. Balancing advice and self-research leads to informed decision-making aligned with genuine protection needs. Deception isn’t prevalent, but the duality of roles demands awareness — good agents nurture transparency for sustained client trust.

Equally, agents may not always communicate the latest policy options driven by technology or market innovations. Vigilance is needed, ensuring your representative advocates for your changing lifestyle needs. Engage in proactive policy modifications, prompting agents to reassess and refine recommendations in real-time.

Yet, transforming the agent dynamic could revolutionize your insurance engagement. Digital platforms offer algorithm-driven pathways to unbiased, data-informed decisions, reducing dependence on human intermediaries. While digital aid is enticing, blending personal oversight ensures no opportunity or tailored protection shape is overlooked, reaffirming trust in both human and tech-support systems.

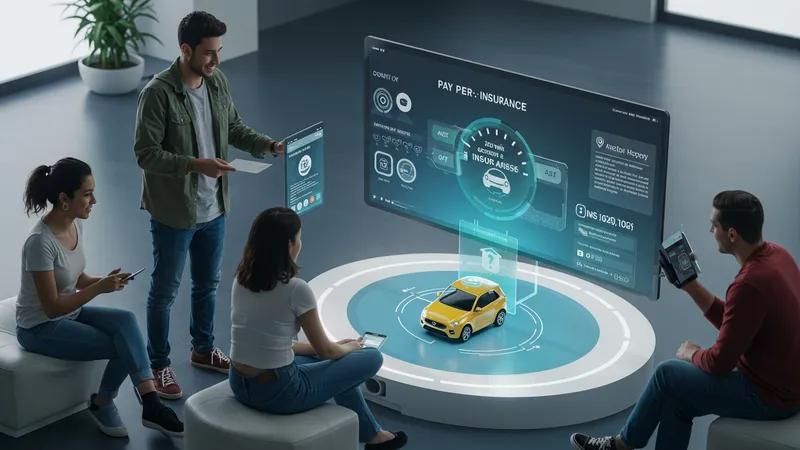

It's no longer just about traditional homeowner plans. Emerging options like pay-per-mile insurance shake up the norm, offering flexibility previously deemed unimaginable. Tailored for minimalists or travelers, they redefine balance between use and cost, rewarding those with lower risk profiles.

These models entice younger demographics favoring convenience and affordability. Embracing an on-demand lifestyle means paying only for what you need when you need it. As enticing as it seems, a clear understanding of coverage limits is vital to avoid surprises at times of need. It's this loophole that demands attention.

What's more, pilot programs are exploring subscription-based coverage with adaptable premiums, aligning with life changes. The insurance industry’s nod toward consumer-centric evolution predicts a potential shift where roles and responsibilities become shared. Multiple pilot schemes drive home the point that the future might indeed be flexible.

One downside remains: not all homes benefit equally from these experimental models. Properties boasting extended absenteeism or high-value items might see less cost-effectiveness. It's a concept rich with both potential and challenges, inviting eager watchers to weigh benefits alongside unknowns so they can move confidently toward a reimagined coverage reality.

Contrary to popular belief, cookie-cutter policies might not always limit flexibility. Their primary appeal often lies in affordability and predictability — they offer reliable coverage at premiums palatable for mainstream consumers. However, matching these policies with personal valuations demands comprehension of standard clauses.

Standardized options often suit those with straightforward needs. Yet, the flipside includes potential exclusions limiting protection for unique property features. The assurance of generic coverage disguises hidden complexities, prompting scrutiny of listed exceptions to avoid future shocks.

Customization typically scares buyers with perceived added costs. In reality, tailor-fitting could surprisingly economize by buoying the long-term profile against unanticipated claims and premium spikes. Balancing risk tolerance leads to carefully considered policies adapting over time with minimal financial strain.

A combined approach of standardized policies cushion against uncertainties while strategically incorporating select enhancements or riders complements specialized needs. Trust in basic policies empowers simplified engagements, invigorating policyholder confidence in their insured assets amidst evolving industry landscapes.

Societal norms and assumptions often intertwine, leading homeowners to believe full coverage is the holy grail. Yet complexities beyond visible surface persist, revealing that comprehensive protection isn’t as all-encompassing as believed. Knowing what isn't covered primes homeowners for optimal decision-making, so coverage truly reflects potential needs.

However, the balance between complete coverage and financial practicality is not often resolved easily. Understanding lifestyle shifts ensures considerations match reality, meaning homeowners continually reassess personal and property changes, re-calibrating as essentials grow or recede, guided by informed agent insights.

In cases where complete coverage was pursued, homeowners frequently face undisclosed local legislation that alters claim pathways. Industry advocacy often remains unheard, underscoring the importance of updated knowledge tailored to your home territory as a failsafe against policy gaps.

Engagement with current discussions forces movement beyond standard paths. Open dialogue discusses potential vulnerabilities insurers may not typically disclose, expanding your coverage landscape and fostering informed decision-making that secures not just assets but peace of mind amid an ever-evolving landscape.

Determined homeowners constantly search for smart ways to reduce premiums without losing coverage. Transport aficionados use comparable auto insurance for surprising leverage — bundling policies reduces costs significantly, creating synergy between home and auto coverage.

Hidden room for negotiation is accessible too. Many policyholders overlook discussing reductions with their agents directly. It's a practice that negotiation-savvy users exploit to clarify unnecessary conditions, incorporating little-known discounts into leaner agreements that fit tight budgets.

Safety improvements like fire suppression systems and storm shutters amplify earnestness among insurers, minimizing perceived risk. One overlooked gain arises from fresh energy audits proving home efficiency — this tangibly benefits premium calculations and achieves higher property valuations.

Eyeing industry trends unveils streamlined deals appearing during off-peak settlement periods — ostensibly static windows where competitive rates allure renewed customer interest. Learning industry rhythm grants foresight into pricing fluctuations, empowering proactive policyholder influence in aligning home protection economically with certainty against disruptors.

Climate change undeniably shifts insurance needs in undeniably novel directions — exacerbated severity of storms or floods necessitates explicit expansion. Conventional policies grapple against new environmental realities clamoring at society’s doorstep, urging expanded notions tasking daft exclusion mentality.

Rising sea levels force greater introspection regarding shore property risks already impacting premiums. Legislative responses reflect growing consciousness demanding innovative policy restructuring protecting investment against newfound climate-induced challenges.

Wisdom gained tackles another overlooked reality: extreme temperatures present risks typically associated with natural disasters. With power-grid stresses and infrastructure demands intensifying, fortifying residential resilience against the climate’s wrath feeds into securing investments intelligently.

Open discussions encourage collaborations expanding shared coverages addressing warming realities extending beyond insurance definitions. Shared experiences reveal overcoming dated paradigms, fostering revised preventive tools to mitigate unforeseen exposures marginalized by traditionalist stalemates favoring status quos unjustly.

Hidden tax implications of insurance receive little attention despite financial ramifications. Business use offsets potential deductibility — clarify mixed structures while ensuring demarcations draw within tax boundary policies for qualified write-offs.

Consequently, prudent advising ensures losses reclaim deductible legitimacy under qualifying criteria. Incidents meeting casualty-loss prerequisites amidst declared disasters cultivate opportunities re-examining policy provisions addressing financial inconsistencies amidst turbulent times.

Another avenue lies in homestead laws potentially shielding financial structures post-loss events from creditors utilizing clear delineations among domestic investments, offering a financial buffer when losses keenly intersect daily ambitions.

Advanced awareness prompts consultative engagement enriching tax-position strategies. Tax experts bespoke insurance-informed bridge confining realization processes — harmonizing fiscal tools within smart homeowner decision-making integrates legal frameworks into personalized insurance landscapes.

In the fast-evolving world of homeowners insurance, the only constant is change. As we unearth surprising truths and hidden complexities, one thing is clear: staying informed can mean the difference between peace of mind and costly surprises. So, take charge; reassess your coverage, explore innovative tools, and don't shy away from negotiating with your provider. Armed with the knowledge from this deep dive, you're now ready to turn the insurance experience into a strategic advantage. Share this with fellow homeowners, bookmark for future reference, and step boldly into the future of home protection.