Mortgage rates are always fluctuating, but did you know there's a hidden gap in mortgage costs between Alexandria, Egypt, and Atlanta, USA? The difference in rates will truly astonish you!

With global financial shifts and local economic changes, understanding these rates is more critical now than ever. Economic trends are making waves across continents, and these cities are at the eye of the storm.

Surprisingly, Egyptian banks are currently offering rates lower than several American giants. While traditionally, the U.S. housing market has been seen as the more stable option, recent financial developments are turning the tables. Alexandria's economic landscape is increasingly dynamic, bending expectations. Even recent legislation is pushing for more affordable housing solutions. But that’s not even the wildest part…

Meanwhile, in Atlanta, a burgeoning tech industry is driving property demand sky-high, leading to a hike in mortgage rates. Still, investors find the region irresistibly attractive due to tax incentives and lifestyle appeal. The tech surge continues to disrupt traditional housing market assumptions, mirroring the city's fast-paced evolution. But what does this mean for future homeowners? What happens next shocked even the experts…

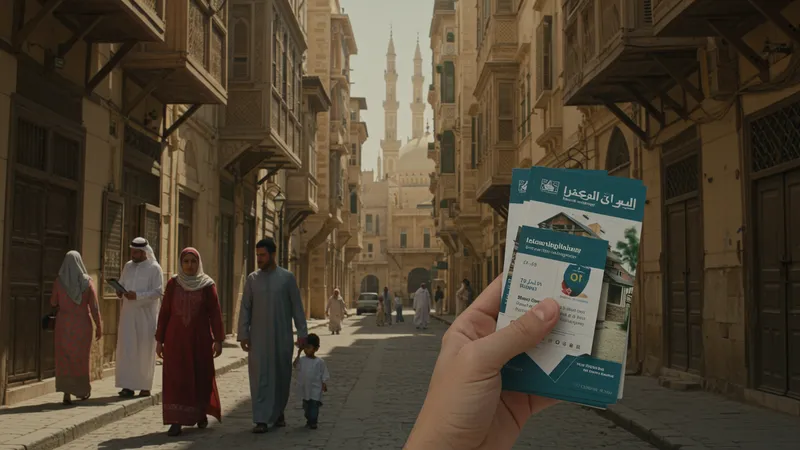

In Alexandria, a resurgence of foreign investment, particularly from Gulf nations, is playing a pivotal role in redefining the housing market. Investors, lured by strategic locations and burgeoning tourism, are pouring capital into residential schemes that redefine urban living standards. The whirlwind of capital inflow is steering an unanticipated economic shift that favors homebuyers. The impact reverberates through construction booms and ambitious infrastructure projects. But there’s an unexpected twist lurking under the surface…

What’s unfolding in Alexandria is a delicate balancing act. As the Egyptian government rolls out policies to stabilize the economy, interest rates oscillate in response to inflationary pressures. These policy decisions aim to cushion the financial ecosystem against turbulent waves from international markets. Yet, homeowners find themselves caught in a riddle: will the rates continue to favorably cater to buyers, or will further inflation adjustments disrupt this trend? What you read next might shift your perspective entirely.

In Atlanta, economic growth is driven by an insatiable demand for tech talents. As giants like Microsoft and Google expand their presence, housing affordability faces challenges amid escalating demand. The job bonanza creates a paradoxical tension where an opportunity-rich environment encounters escalating living costs. But here’s an industry secret: a financial strategy tailored to such a booming marketplace not only mitigates costs but can potentially flip the narrative for homeowners!

Curious investors and first-time buyers should closely monitor Atlanta’s financing trends. The allure of competitive fixed-rate mortgages alongside flexible adjustable options presents a dual advantage for savvy negotiators. Anticipated fiscal policies aiming to stabilize inflation hint at low-risk, high-reward scenarios for strategic buyers. However, Cautiously navigating through this evolving landscape could unveil lucrative prospects lying just beneath the surface.

In the heart of Alexandria, culturally ingrained notions about home ownership heavily influence consumer behavior. Houses aren't just assets; they represent familial legacy and long-term security. This cultural emphasis drives local demand, pressing banks to innovate mortgage solutions that cater to these deeply rooted values. Cultural factors aren’t just shaping the rates; they’re reshaping the real estate approach altogether.

The interplay between traditional values and modern financial strategies highlights a unique scenario. Alexandria banks are innovating by introducing Sharia-compliant mortgages, offering appealing options that align with local preferences. This sensitive market adaptation, aligning religious principles with economic demands, crafts a unique dynamic that’s captivating global attention. But is this trend sustainable long-term, or will market volatility test its boundaries?

Conversely, Atlanta’s housing market reflects an entirely different cultural tapestry. Younger, diverse populations bring varied preferences, seeing homes as gateways to community identity and personal expression rather than strictly financial assets. This shift encourages housing developments that embrace diverse lifestyles, creating vibrant, multifaceted neighborhoods.

As Atlanta’s cultural melting pot diversifies, its housing market responds to such influence by offering flexible lending options tailored to diverse demographics. By introducing comprehensive financial inclusivity practices, mortgage lenders are exploring undiscovered opportunities. This culture-centric banking evolution seeks to redefine accessibility and affordability in unexpected yet progressive ways.

In Alexandria, recent government initiatives have aimed to fortify housing markets against global economic shifts. By offering subsidies for first-time homebuyers and slashing high VAT rates on real estate, these actions cultivate a fertile ground for domestic buyers. Pressure mounts, however, as international financial organizations scrutinize such policies, pondering the longevity and sustainability of these subsidies. But as layers peel back, the question remains: what's the real cost of these market interventions?

The Alexandrian government faces a delicate act. Policies have successfully drawn locals into the housing market, stimulating local economies, but hidden dependencies on such stimulus raise red flags. How long can these measures uphold a booming housing scene without the crutches of government support? And, more importantly, what are the unforeseen consequences of their withdrawal? As you ponder these questions, another layer of intrigue awaits.

In Atlanta, policy-driven initiatives focus on tech expansions and streamlined zoning laws. Recent legal changes aim at reducing red tape, encouraging swift, expansive developments to match demand surges. While these policies offer short-term growth, long-term implications unfold an entirely new story. What shadows do these 'fast-track' approvals cast on overall housing quality and sustainability? Sometimes, what's beneath the surface holds greater intrigue than what's above.

As Atlanta continues evolving under these policies, first-time buyers find themselves walking a tightening rope between affordability and quality. Loose zoning regulations and expeditious project approvals deliver options, but at what price? Nuanced insights from real estate experts forewarn of potential pitfalls hidden in plain sight. Are these initiatives supporting a thriving economy or merely a temporary mirage? The answer is elusive yet tantalizing.

Understanding the nuances between mortgage rates in Egypt and the USA involves diving into complex variables. Exchange rates, inflationary pressures, and fiscal policies foster diverse outcomes in each country. Analyzing these figures offers a revealing narrative that may reshape investor strategies. The contrast between Alexandria's low rates and Atlanta's surging demands reflects broader economic crosscurrents shaping the global housing industry.

Why do these contrasting figures exist, and what drives them? Insights reveal how Egypt's central bank interventions, aimed at controlling inflation, indirectly kept mortgage rates accessible. Conversely, the Federal Reserve's decisions echo different philosophies, counteracting inflation through interest rate hikes, directly impacting the U.S. housing market. The juxtaposition stands as both a mystery and a pattern: two economies tethered yet divergent.

This intriguing comparison unveils an emerging opportunity for international investors to optimize portfolios by leveraging exchange rate fluctuations. By strategically balancing investments in these disparate yet interconnected markets, there lies an untapped potential for significant gains. But what shadows accompany these rewards? Does this strategic balance hold when external market forces shift unexpectedly?

As economic analysts dig deeper, the nuanced shifts between these mortgage rate structures uncover anomalies. Varying market resilience between Alexandria and Atlanta offers unexpected lessons for global investors. Can these insights stack the deck in your favor, or will unforeseen variables upend informed decisions? The next revelation may redefine your investment philosophy entirely.

Technology's infiltration into the mortgage arena is revolutionizing day-to-day operations. Digital platforms in Alexandria are leveraging AI to transform customer experiences, analyzing eligibility quickly and efficiently. With streamlined processes, the city stands as a beacon of innovation, connecting lenders with prospective buyers effectively. This digital evolution doesn't just represent progress; it heralds a new era of accessibility and efficiency backed by cutting-edge technology.

Alexandria's embracement of digital shifts highlights the blend of tradition and modernity. As virtual consultations and AI-driven assessments become commonplace, a new chapter in home financing unfolds, promising faster, error-free transactions. Existing paradigms face exhilarating challenges and prospects with unimaginable digital prowess. Yet, one burning question remains: how sustainable is this tech transformation amid fluctuating real-world infrastructures?

In contrast, Atlanta's fintech landscape is breaking barriers, bridging gaps in the housing market through advanced analysis tools. By harnessing predictive analytics, mortgage lenders tackle future uncertainties, aligning with individualized client objectives seamlessly. What digital leverage can unlock better outcomes in Atlanta's dynamic marketplace, and how can these become replicable models globally?

Yet, this tech-driven evolution in Atlanta leaves room for scrutiny. The potential pitfalls lie in data privacy and accessibility for less tech-savvy demographics—a double-edged sword that innovates yet marginalizes. As these innovations forge pathways in the housing domain, they simultaneously carve out avenues for addressing social disparity concerns. How far can this tightrope walk between innovation and inclusivity continue?

With Alexandria's young population embracing modern lifestyles, a noticeable shift towards more sustainable and efficient housing emerges. This trend shapes mortgage demands, as environmentally conscious buyers seek homes that fit these new ecological paradigms. Smart homes, equipped with energy-efficient technologies, are seeing increasing attraction—an insight that compellingly changes market offerings.

What does this green awakening mean for mortgage lenders in Alexandria? Borrowers are increasingly leaning towards eco-friendly financing packages, prompting financial institutions to redefine packages to incorporate green technology incentives. This budding shift not only influences buyer choices but opens dialogue on sustainable financial practices worldwide. It’s a trend that’s telling the future story of Alexandria more clearly than ever.

Similarly, in Atlanta, the urban migration trend continues to surge, driving a newfound demand for vibrant urban living spaces. As professionals flock to city centers, micro-apartments and co-living arrangements become leasing staples. This demographic shift steers the Atlanta housing market toward accommodating versatile living spaces that meet the diverse tastes of urban settlers.

The evolving demand sees Atlanta’s financial institutions adjusting mortgage packages, offering competitive terms conducive to these transformative living scenarios. But can these swiftly-changing social preferences suggest broader, long-term shifts in the housing market that will defy traditional trajectories? What do these emerging trends indicate for the future of real estate, and where do they lead the savvy investors?

The housing landscapes in both Alexandria and Atlanta are poised for dynamic shifts as 2025 approaches. Analysts project contrasting scenarios, driven by local and global economic signals. Alexandria stands on the cusp of potentially tapping into untethered growth, contingent on stability in its political milieu and currency factors. This potential pivot invites a deep dive into strategic financial maneuvers that could unlock significant wealth.

Future forecasts prompt Egyptians to utilize emerging market catalysts, where adapting to unfolding legislative adjustments promises fruitful avenues. Anticipated economic recovery initiatives propose to stabilize interest rate fluctuations, bolstering mortgage market optimism. Herein lies the makers' pivotal test: capitalizing on these emerging opportunities within Alexandria’s financial scaffolding.

Atlanta's forward-looking vision aligns with digital-first financial practices, reflective of technological proficiency dominating the region's discourse. Predictive financial trends link closely to the accelerated pace, shaped by continually expanding tech startups. The tech boom fosters housing demand, heralding innovative lending products tailored ambitiously for niche markets seeking to leverage Atlanta’s economic dynamism.

Is this fast-growing digital trend in Atlanta a timeless trajectory, or will unforeseen market corrections dampen its velocity? The anticipation of 2025 brings questions and intrigue worth investigating, influencing decisions that could reshape financial destinies immediately. What hidden variables stand ready to alter projected paths and adjust market tempo in uncharted ways?

Global economic tides wield significant influence over local mortgage markets in both Alexandria and Atlanta. This interplay of economic conditions and their trickle-down effects cannot be overstated. Fluctuating currency exchange rates and international trade agreements sculpt an intricate landscape for homeowners and lenders alike, augmenting market resilience strategies.

A closer inspection of Alexandria’s housing market reveals its vulnerability to international shifts, with foreign exchange volatility spilling over into mortgage rate adjustments. Strategic alignment between Egypt's banking reforms and global hopes rest on a delicate balance. Can Alexandria sustain its growth momentum through these fluctuations, or will it succumb to external economic tremors altogether?

In Atlanta, global economic currents have equally profound impacts. The city’s thriving economy remains tethered to US international trade policies and manufacturing exports. Changes within these parameters experiment directly with housing rates, challenging developers and financiers to adjust investments accordingly. But will the imminent global economic tide prop Atlanta’s rapid expansion, or could it signal a pivotal reconfiguration of expansion plans?

As Alexandria and Atlanta navigate this global fiscal mosaic, investors globally must prepare to pivot strategically. Will savvy financial maneuvers unlock valuable insights amid a turbulent economic voyage? Or will unseen forces inadvertently redirect market trajectories beyond feasible control? Illumination awaits those who dare peer deeper, examining factors that define their investment saga.

Esteemed economists and real estate experts underscore the importance of proactive strategies in navigating Alexandria’s uncertain financial waters. Strategic recommendations revolve around diversifying portfolios to secure assets against fluctuating interest rates and currency exchanges. Within this skepticism lies opportunity for considerable fiscal gains, albeit for the vigilant and the agile.

Industry insiders advocate specialized mortgage products tailored to Egypt’s evolving market dynamics. This specialization involves embracing bespoke financial instruments that are resilient against inflationary impacts. Are these strategies integral to ensuring competitive advantages and preserving wealth? Or does the mastery of these tools entail navigating unpredictable economic waves?

Meanwhile, Atlanta’s tech-driven boom continues to captivate financial strategists with insights suggesting agile investment pivots. This approach nurtures partnerships with mortgage brokers innovatively crafting deals laced with digital technology perks, courting millennials and tech-savvy homeowners. Are the tech-infused trends becoming a benchmark in real estate investments, or are they just temporary shifts catering to modern-day whims?

The call for preparedness among Atlanta’s financial leaders insists on translating technological dominance into tangible outcomes, solidifying contributor roles to a broader economic architecture. Can these suggestions form the bedrock of a thriving Atlanta economy, or will unforeseen developments unravel these ambitious projections? The roadmap unfolds as both a guide and a wager.

Alexandria presents itself as a beacon of opportunity for innovative investors discerning undervalued prospects. Market foresight positions Alexandria's cultural and economic location as a prime candidate for wealth accumulation strategies. Amidst Egypt’s rapid urbanization, identifying lucrative pockets of growth becomes synonymous with keen investment acumen.

However, potential investors should remain wary of localized pressures and societal shifts dictating Alexandria's real estate story. Intricate local economic factors can either accelerate return on investment or complicate future projections. These trepidations challenge forecasts and add a layer of complexity to potential strategic gains, painting a rich tapestry of the investment landscape.

In contrast, Atlanta thrives as a hub of explosive growth, boasting a fertile ground for houses meeting the growing urban demand. The architectural renaissance underway coexists with technological advancement sprinkled across every sphere of the city. But is Atlanta’s real estate pathway emboldened by robustness or tested by rapid expansion’s inherent challenges?

Anticipating shifts, investors exploring Atlanta are encouraged to weigh implications tied to neighborhood revitalization and expanding development boundaries. Progressive insights promise potential returns yet mandate logistical foresight in negotiating an evolving real estate market. The pull between risk and reward carves an intricate journey for keen navigators. Where will the roads lead in a dynamically transforming cityscape?

Alexandrian buyers exhibit nuanced attitudes reflective of their cultural and economic landscape. Home ownership often embodies not just financial aspirations but familial stability and cultural continuity. This deep-rooted sentiment permeates decision-making, allowing lenders to cater specifically to personalized preferences. Can these culturally sensitive approaches dish out competitive edges in the lending environment?

Lenders meticulously watch these consumer pulses, embracing empathetic product design that resonates with localized values. How enduring are these consumer narratives in defining Alexandria’s evolving housing framework? Is the rise in personalized lending options destined to stay or fleeting adaptations within broader economic transformations?

In Atlanta, understanding buyer psychology unveils an identity deeply entwined with career ambitions and social mobility. Young professionals and tech visionaries flock to spaces mirroring dynamic advances and progressive ideals. This buyer’s mindset invites strategic lending approaches that mirror lifestyle pursuits and modern housing analogies tailored for varied consumer bases.

The influence of buyer psychology in Atlanta encapsulates diversity, signaling mortgage lenders to innovate continuously. Navigating these cognitive landscapes demands foresight and innovation in creating persuasive lending solutions aligning with shifting generational attributes. Are such adaptive channels shaping Atlanta’s future lending paradigm? The emerging patterns present both queries and resolutions for future housing initiatives.

With Alexandria's urban resurgence, environmental concerns sporadically come to the fore. Housing developments increasingly contend with ecological constraints as the city balances growth and sustainability. Implementing green building protocols is now intertwined with mortgage rate decisions, incentivizing environmentally conscious planning. Where shall trade-offs between economic ambition and ecological justice lead?

The sustainability rhetoric intertwines Alexandria’s housing narrative with eco-friendly solutions, compelling both developers and lenders to ensure harmonious coexistence. Will this push for sustainability alter mortgage scenarios as more sustainable products attract competitive motives and financial inducements favorable to these novel approaches?

In Atlanta, environmental imperatives bear direct financial implications on urban development strategies. Initiatives incentivizing sustainable housing developments pledge an overlap between ecological priorities and financial benefits unlocked via green mortgage solutions aimed at eco-conscious income groups. Nevertheless, how genuine is the shift, and does it go beyond surface motivations?

As Atlanta reinscribes its environmental footprint, the sustainability ethos reverberates through mortgage projections and real estate tact. Are these strategies harbingers of a broader paradigm shift, anchoring eco-inclusivity into mainstream housing policies? Or are they part and parcel of broader gestural narratives linked to contemporary trend-setting preferences?

The tale of Alexandria vs. Atlanta is one of contrasts, opportunities, and evolving landscapes. Each city, with its unique dynamics, redefines real estate paradigms on distinct factors—cultural influences, technological disruptions, and economic fluctuations framing their divergent stories. What lens will investors use in viewing these cities’ housing journeys?

Alexandria’s intriguing influx of investments and urban advances spin a promising yet delicate web, dependent on sustaining growth amid regulatory recalibrations. Meanwhile, Atlanta’s tech-driven surge continuously injects life into expanding boundaries and undertakes emerging risks. Does this competitive tale unearth new possibilities, and under what conditions do these narratives converge?

In the larger frame, both cities reflect broader global trends—an interplay of local actions catalyzing international real estate decisions. The evolving discourse around social responsibility, cultural preferences, and economic mobility shape different hues of these atmospheric cities. Their socio-economic trajectories ripple further than perceived, inviting measured exploration.

As contrasting as these tales are, they unlock a universe of strategic diversions vital for investors and stakeholders poised to journey across global real estate tapestries. But the closing question lingers: which approach wins this reshaping battle, maintaining authenticity amidst a cauldron of rapid progressions? The ongoing episodes surely promise revealing outcomes ahead.

The Alexandria-Atlanta real estate comparison encapsulates vital lessons in adaptability, cultural relevancy, and strategic foresight. Embracing such insights extends the playing field for global stakeholders navigating housing markets. Whether you’re a seasoned investor or a curious learner, the stories behind these cities invite reflection and actionable endeavors. Share this exploration, dive deeper into its nuance, and perhaps, uncover the next big investment chapter. The journey, after all, is just beginning.